How to Calculate Interest Compounded Semi-annually

In order to create a good financial plan, you should know how your investments work. A crucial factor that you should consider while selecting an investment is interest.

In this article, we will explain how interest compounded semi-annually can help you.

When a person makes an investment, he/she can understand how the interest will be calculated. If he/she has selected an option that provides compound interest, then such an investment can help him/her earn substantial returns.

Compound interest can help a person gain interest on his/her investment amount. When an individual invests in an investment instrument that provides compound interest, then interest will be added to his/her principal amount. Then, in the next term, the interest will be added to the new amount, which is made of the principal amount and the interest from the previous term. Thus, the investment amount will keep growing during the investment period. Therefore, allowing the investor to earn good returns. Furthermore, the frequency of compound interest can vary, such as annually, semi-annually, etc.

Let’s take a look at how interest is compounded semi-annually-

When interest is compounded semi-annually, it refers that the compounding term is six months. Compounding interest semi-annually means the principal amount when the compounding period begins comprises the total interest from every previous term. The interest from each term is added to the principal when interest is compounded.

Why People Should Understand Interest Compounded Semi-annually

- By understanding semi-annual compound interest, a person can calculate the effective interest rate. He/she will be able to know the total interest rate while the interest accrues.

- It is important to understand semi-annual compound interest as it can help a person describe interest gained on financial reports.

- It can also help a person know the amount of interest he/she will accrue over the period for budgeting.

Calculating Compound Interest Semi-annually

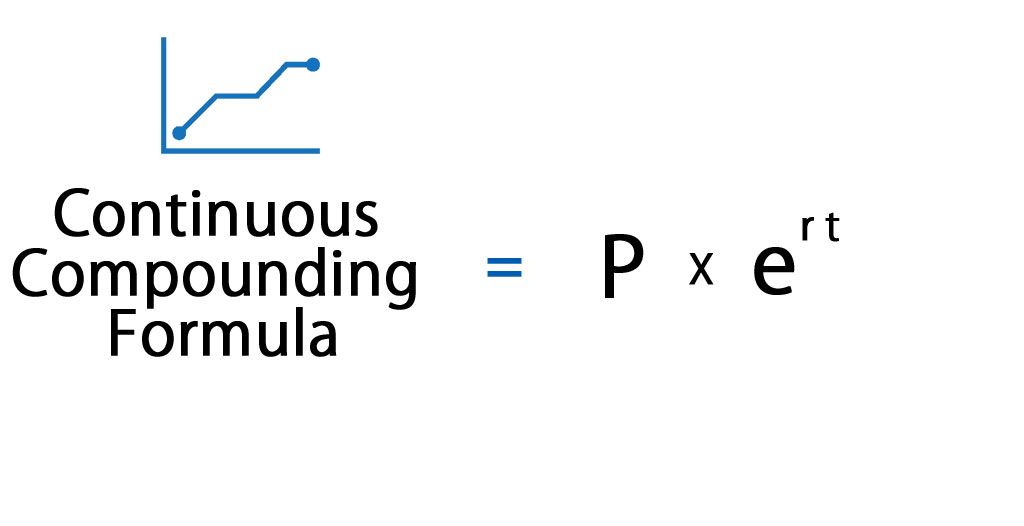

The formula to calculate compound interest is-

P[(1+i)^n-1]

Here is an example of how interest is compounded semi-annually-

A person invests Rs. 6,000 in an investment for five years. He is going to receive 3% semi-annual compound interest.

- First, change the interest rate to decimal- 3/100= 0.03

- Determine the number of compounding terms

In this case, interest will be calculated over five years. Every year will have two compounding periods, except for the first year. The first year will have one compounding period. Therefore, in total, there are 9 compounding periods.

- Use the formula

6,000[(1+.03)^9-1]= Rs. 1,830.

The total interest accrued over the five years will be Rs. 1,830.

Compound Interest Calculator

While calculating compound interest manually, a person can make errors. However, he/she can use a compound interest calculator to calculate the amount easily.

How to Use Compound Interest Calculator?

To start the calculation, the person should first enter the amount of money he/she has for investment in the calculator. Next, the person can add more amount to the investment at regular periods. Then, the person must select the number of years he/she wants to invest for. Next, the person can add the rate of interest to understand how much money he/she can make at the end of the tenure.